All Categories

Featured

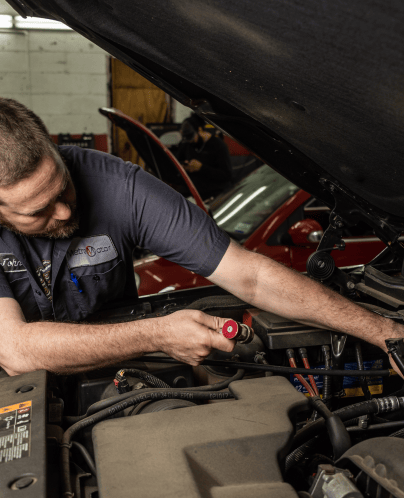

When your automobile calls for major repairs, the prices can be a hefty economic problem. Whether it's an important engine issue, transmission failing, or other pricey fixing, managing these costs without disrupting your spending plan can be a challenge. The good news is, there are a selection of financing options that can help you spend for major automobile repair work over time. Here's a take a look at some of the most effective alternatives for funding your auto repairs.

![]()

Pros: Convenient, as funding is prepared straight via the store. Numerous shops offer deferred interest for details timespan (e.g., 6-12 months), permitting you to pay off the balance without passion if it's paid completely within the advertising duration. Disadvantages: Rate of interest might raise after the advertising period ends, and approval might be based upon your credit background. Not all stores supply this option, so it may not constantly be offered. 2. Individual Financings. Individual lendings from a bank, cooperative credit union, or online lender can be an exceptional choice for funding large repair work costs. These financings normally use set passion prices and predictable regular monthly settlements, making it much easier to prepare for payment. Personal lendings are functional and can be used for any kind of repair work.

Pros: Lower rate of interest than bank card and adaptable loan quantities. You might also have the ability to borrow a larger sum for significant fixings. Disadvantages: Financing approval is typically based on your credit rating. It can take a number of days to obtain authorization, and the process might entail documentation or charges. In addition, financing terms can range from a few months to several years, so consider your ability to pay off the funding. 3. Credit rating Cards. It can be an effective way to finance car fixings if you currently have a credit card with a low interest price or a 0% APR promotional deal. Some debt cards supply incentives or cash-back rewards, which can aid offset several of the repair prices.

![]()

Pros: Immediate accessibility to funds, and 0% APR provides enable you to spread payments in time without paying interest (if settled throughout the initial period) Some cards likewise use cash money back or benefits. Disadvantages: If the 0% APR period ends and the equilibrium is not repaid, the rate of interest can be high. If you do not repay the debt rapidly, you can sustain substantial costs. Furthermore, bring a large balance on your card may adversely influence your credit history. 4. Home Equity Lending or HELOC. If you have considerable equity in your house, you may be eligible for a home equity lending or a home equity credit line (HELOC) These lendings allow you to borrow versus the value of your home, usually at a reduced rates of interest than other sorts of funding.

Pros: Lower rate of interest rates contrasted to individual finances or bank card. You can obtain a bigger amount for repair work, which might be helpful for substantial repairs. Disadvantages: Utilizing your home as collateral suggests that stopping working to pay back the loan could result in losing your home. The authorization procedure is a lot more engaged and can take longer compared to various other financing options. 5. Vehicle Repair Work Loans. Some specialized lenders supply vehicle repair service financings especially created to cover the cost of vehicle repair services. These finances function likewise to individual lendings however are customized to auto-related costs. They may provide affordable rate of interest and terms, relying on your creditworthiness.

![]()

Pros: These financings can use lower prices than charge card and are especially developed to assist with auto repair work, implying the application procedure might be much more structured. Disadvantages: Approval usually depends on your credit report. The finance amounts might be restricted based on your credit report and the nature of the repair. 6. Insurance policy Coverage. If your lorry's repair work is related to an accident or damages covered by your insurance plan, your insurance policy company might cover some or all of the cost of repair services. Comprehensive, crash, or perhaps mechanical malfunction insurance coverage can possibly help with significant repair costs.

Pros: If your fixing is covered under your insurance coverage plan, it can save you from paying out-of-pocket. Furthermore, your insurance service provider can advise trusted repair work shops. Disadvantages: You might still need to pay a deductible, and not all repair work are covered under standard plans. Additionally, your premiums might boost after submitting a case. 7. Payday Loans (Not Suggested) While payday car loans can give quick accessibility to funds, they are typically not suggested because of their very high-interest prices and short payment terms. These car loans can catch customers in a cycle of financial obligation if they're not settled on time.

Pros: Access to money promptly. Disadvantages: Exceptionally high-interest prices and charges can make these financings a pricey alternative. If you're incapable to repay the loan completely, the financial obligation can promptly spiral out of control, leading to extreme economic consequences. 8. Auto Mechanic Payment Plans. Some automobile service center use repayment strategies for customers to cover the price of fixings in installments. These strategies might include interest-free periods or low-interest prices, making it an extra budget-friendly alternative if you need to take care of big repair costs.

Pros: Versatile terms that permit you to repay the repair service prices with time. If paid off within a defined time frame, several settlement strategies consist of no-interest or low-interest periods. Disadvantages: Not all shops supply this solution, and terms may differ extensively relying on the shop. See to it to clear up the information of the payment routine and any kind of charges that might use. Conclusion. The best funding alternative for your car repair service will depend on the seriousness of the repair work, your economic scenario, and your capacity to settle the lending. Alternatives like automobile repair work shop funding, individual car loans, and credit scores cards supply prompt access to funds, while home equity fundings and vehicle repair fundings provide bigger financing quantities at possibly reduced rates.

- Vehicle Repair Service Store Funding. Numerous vehicle service center provide financing options to customers that need to spread out the price of pricey repair work. This can be via internal settlement strategies or collaborations with third-party lending institutions. These strategies are created to supply an immediate service to those that can not afford to pay for repairs ahead of time.

Pros: Convenient, as funding is prepared straight via the store. Numerous shops offer deferred interest for details timespan (e.g., 6-12 months), permitting you to pay off the balance without passion if it's paid completely within the advertising duration. Disadvantages: Rate of interest might raise after the advertising period ends, and approval might be based upon your credit background. Not all stores supply this option, so it may not constantly be offered. 2. Individual Financings. Individual lendings from a bank, cooperative credit union, or online lender can be an exceptional choice for funding large repair work costs. These financings normally use set passion prices and predictable regular monthly settlements, making it much easier to prepare for payment. Personal lendings are functional and can be used for any kind of repair work.

Pros: Lower rate of interest than bank card and adaptable loan quantities. You might also have the ability to borrow a larger sum for significant fixings. Disadvantages: Financing approval is typically based on your credit rating. It can take a number of days to obtain authorization, and the process might entail documentation or charges. In addition, financing terms can range from a few months to several years, so consider your ability to pay off the funding. 3. Credit rating Cards. It can be an effective way to finance car fixings if you currently have a credit card with a low interest price or a 0% APR promotional deal. Some debt cards supply incentives or cash-back rewards, which can aid offset several of the repair prices.

Pros: Immediate accessibility to funds, and 0% APR provides enable you to spread payments in time without paying interest (if settled throughout the initial period) Some cards likewise use cash money back or benefits. Disadvantages: If the 0% APR period ends and the equilibrium is not repaid, the rate of interest can be high. If you do not repay the debt rapidly, you can sustain substantial costs. Furthermore, bring a large balance on your card may adversely influence your credit history. 4. Home Equity Lending or HELOC. If you have considerable equity in your house, you may be eligible for a home equity lending or a home equity credit line (HELOC) These lendings allow you to borrow versus the value of your home, usually at a reduced rates of interest than other sorts of funding.

Pros: Lower rate of interest rates contrasted to individual finances or bank card. You can obtain a bigger amount for repair work, which might be helpful for substantial repairs. Disadvantages: Utilizing your home as collateral suggests that stopping working to pay back the loan could result in losing your home. The authorization procedure is a lot more engaged and can take longer compared to various other financing options. 5. Vehicle Repair Work Loans. Some specialized lenders supply vehicle repair service financings especially created to cover the cost of vehicle repair services. These finances function likewise to individual lendings however are customized to auto-related costs. They may provide affordable rate of interest and terms, relying on your creditworthiness.

Pros: These financings can use lower prices than charge card and are especially developed to assist with auto repair work, implying the application procedure might be much more structured. Disadvantages: Approval usually depends on your credit report. The finance amounts might be restricted based on your credit report and the nature of the repair. 6. Insurance policy Coverage. If your lorry's repair work is related to an accident or damages covered by your insurance plan, your insurance policy company might cover some or all of the cost of repair services. Comprehensive, crash, or perhaps mechanical malfunction insurance coverage can possibly help with significant repair costs.

Pros: If your fixing is covered under your insurance coverage plan, it can save you from paying out-of-pocket. Furthermore, your insurance service provider can advise trusted repair work shops. Disadvantages: You might still need to pay a deductible, and not all repair work are covered under standard plans. Additionally, your premiums might boost after submitting a case. 7. Payday Loans (Not Suggested) While payday car loans can give quick accessibility to funds, they are typically not suggested because of their very high-interest prices and short payment terms. These car loans can catch customers in a cycle of financial obligation if they're not settled on time.

Pros: Access to money promptly. Disadvantages: Exceptionally high-interest prices and charges can make these financings a pricey alternative. If you're incapable to repay the loan completely, the financial obligation can promptly spiral out of control, leading to extreme economic consequences. 8. Auto Mechanic Payment Plans. Some automobile service center use repayment strategies for customers to cover the price of fixings in installments. These strategies might include interest-free periods or low-interest prices, making it an extra budget-friendly alternative if you need to take care of big repair costs.

Pros: Versatile terms that permit you to repay the repair service prices with time. If paid off within a defined time frame, several settlement strategies consist of no-interest or low-interest periods. Disadvantages: Not all shops supply this solution, and terms may differ extensively relying on the shop. See to it to clear up the information of the payment routine and any kind of charges that might use. Conclusion. The best funding alternative for your car repair service will depend on the seriousness of the repair work, your economic scenario, and your capacity to settle the lending. Alternatives like automobile repair work shop funding, individual car loans, and credit scores cards supply prompt access to funds, while home equity fundings and vehicle repair fundings provide bigger financing quantities at possibly reduced rates.

Latest Posts

Discover Why Chicago Drivers Prefer Montclare Auto Repair for Trusted Service and Significant Savings

Published May 31, 25

1 min read

How Regular Car Maintenance at Montclare Auto Repair Keeps Your Wallet Happy

Published May 22, 25

1 min read

Experience Your Financial Partner at WyHy – Low Rates for Wyoming Residents

Published May 22, 25

1 min read

More

Latest Posts

Discover Why Chicago Drivers Prefer Montclare Auto Repair for Trusted Service and Significant Savings

Published May 31, 25

1 min read

How Regular Car Maintenance at Montclare Auto Repair Keeps Your Wallet Happy

Published May 22, 25

1 min read

Experience Your Financial Partner at WyHy – Low Rates for Wyoming Residents

Published May 22, 25

1 min read